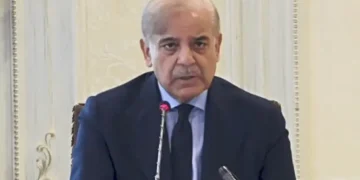

ISLAMABAD; Prime Minister Shehbaz Sharif has termed the ongoing reforms within the Federal Board of Revenue (FBR) as a promising development for Pakistan’s economic stability. Chairing a high-level review meeting on Wednesday, he emphasized that while the progress is commendable, there is a pressing need to make the reforms sustainable and to ensure their completion within the designated timeframe.

The Prime Minister highlighted that aligning the country’s tax system with modern global standards is crucial not only to increase national revenue but also to ease the tax burden on the common citizen. He noted that these reforms, including the digitalization of FBR and enhanced enforcement efforts, have led to a historic 1.5 percent increase in the tax-to-GDP ratio.

The meeting was informed that the number of individuals filing tax returns has crossed 7.2 million in 2025 — a notable improvement from the previous year.

PM Shehbaz instructed authorities to bolster enforcement measures to curb the informal economy, and to prepare a detailed restructuring plan for the FBR’s digital wing, with clearly defined targets and deadlines. He also directed that tax reform initiatives must be inclusive, incorporating input from stakeholders such as the business community and international experts.

The Prime Minister praised the efforts of FBR officers involved in the reform process and asked them to present a comprehensive report next week, outlining achievable goals and a clear implementation timeline.

According to official statement; Prime Minister Muhammad Shehbaz Sharif has expressed satisfaction with the ongoing reforms in the Federal Board of Revenue (FBR), terming the improvements in the tax system as “welcome.”

He has directed that measures be taken within a specified timeframe to create a tax system aligned with modern requirements. The Prime Minister made these remarks today while chairing a review meeting on the FBR’s ongoing reforms.

The Prime Minister lauded the FBR’s digitalization efforts for assisting in achieving targets and instructed that steps be taken to establish a sustainable system on a permanent basis. He emphasized the need for further enforcement measures to curb the informal economy.

The Prime Minister also directed the FBR to develop a comprehensive action plan for the re-establishment of its digital wing, including defining timelines for achieving targets.

During the meeting, the Prime Minister also stated that consultations with all stakeholders, including businesses, the trading community, and taxpayers, must be ensured, and their suggestions incorporated into the reform process. He clarified that increasing national revenue through an improved tax system and reducing the tax burden on the common person are among the top priorities.

The meeting received a detailed briefing on the FBR’s reforms, the results of its initiatives, and the targets for the previous fiscal year. It was reported that due to the FBR’s enforcement measures and other reforms, there has been a historic 1.5% increase in the tax-to-GDP ratio in 2025 compared to 2024.

The briefing further stated that the number of tax filers increased from 4.5 million in 2024 to over 7.2 million by June 30, 2025. The FBR’s faceless customs clearance system has not only increased tax revenue but will also reduce clearance time from 52 hours to just 12 hours within the next three months.

In the retail sector, an additional PKR 455 billion in income tax was collected by June 30, 2025, compared to 2024. This increase was attributed to the implementation of Point of Sales (POS) systems, the integration of retailers’ systems with the FBR, and enhanced enforcement. A special system for reviewing the faceless system has been introduced, where cases are being decided promptly via video link.

According to the briefing, these measures have led to a 2.16% reduction in the weighted average tariff on imports, which will decrease raw material costs for industries and facilitate the manufacturing sector. Suggestions from international experts will also be incorporated into tax reforms and the digitalization of economic sectors. Existing data will be utilized more effectively for the registration of industrial production phases with government agencies.

The Prime Minister commended the efforts of FBR officials and personnel involved in the reform process, directing them to present actionable targets and timelines for the proposed suggestions next week.

The meeting was attended by Federal Minister for Information and Broadcasting Attaullah Tarar, Federal Minister for Economic Affairs Division Ahad Khan Cheema, Federal Minister for Law Azam Nazeer Tarar, Chairman FBR, and other relevant senior officials.