ISLAMABAD; Prime Minister Shehbaz Sharif on Monday emphasized that Pakistan’s move toward a cashless economy is crucial for achieving lasting economic stability and sustainable development.

Chairing a high-level meeting on the implementation of digital financial systems, the prime minister said that the global economy is rapidly moving towards digitalisation, and Pakistan must not lag behind. “The entire world is heading toward a digital economy; Pakistan must also advance in this direction,” he remarked.

He noted that his government had placed special focus on promoting digitalisation from the beginning of its tenure, and the positive results were now becoming visible. Citing an example, he said that for the first time during the holy month of Ramazan, financial assistance under the Benazir Income Support Programme (BISP) was successfully transferred to eligible families through digital wallets.

Shehbaz Sharif said that a cashless economy would not only improve governance but also help reduce corruption by ensuring transparency in all financial transactions. He directed all concerned departments to meet their targets within the set deadlines and intensify awareness campaigns in rural and less-developed areas to reduce dependence on cash transactions.

The prime minister commended the Ministry of Finance, the Ministry of Information Technology, the Federal Board of Revenue (FBR), the State Bank of Pakistan, and other relevant institutions for making satisfactory progress toward implementing the roadmap for a cashless economy.

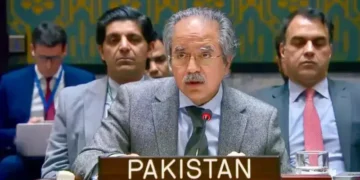

During the meeting, officials briefed the premier on the progress of multiple initiatives under the digital economy vision. It was informed that payments for electricity and gas bills are now being facilitated through Raast QR codes, allowing billions of rupees in transactions to be processed digitally.

The meeting was further told that around 10 million digital wallets under BISP would be activated by the end of the current month, enabling the next tranche of financial aid to be disbursed electronically.

Officials also informed the PM that mobile applications designed for government services in Islamabad would soon be integrated with the Raast system, while new business licensing procedures had been linked to digital payment systems. The facility of payment via QR codes has also been introduced in retail shops nationwide.

In addition, the government has started issuing licenses for establishing digital banks across the country to strengthen financial inclusion. “Through these steps, financial inclusion has reached over 68 percent of the population, and further progress is expected by next year,” the briefing noted.

PM Shehbaz directed that the scope of financial inclusion be expanded further to ensure easy access to banking and digital financial services for all citizens, particularly in remote areas.

The meeting also discussed next year’s targets for expanding the digital economy and improving coordination among institutions.

Federal Ministers Muhammad Aurangzeb, Ahad Khan Cheema, Attaullah Tarar, Shaza Fatima Khawaja, Minister of State Bilal Azhar Kayani, Governor State Bank Jameel Ahmed, NADRA Chairman Lt Gen Muhammad Munir, FBR Chairman Rashid Langrial, and other senior officials attended the meeting.