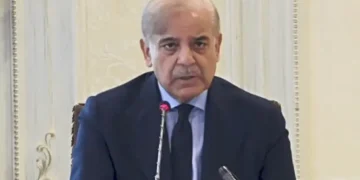

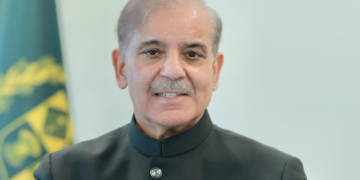

ISLAMABAD; The Power Division has formally invited Prime Minister Shehbaz Sharif to witness the signing of agreements with commercial banks for raising Rs 1.225 trillion in loans, a major step aimed at easing the country’s chronic circular debt in the power sector.

The debt, once at a staggering Rs 2.5 trillion, has been reduced to nearly Rs 1.7 trillion, but remains a pressing financial burden.

According to official sources, all procedural and legal formalities have now been completed with 18 participating banks. The boards of power distribution companies (Discos), the Central Power Purchasing Agency-Guaranteed (CPPA-G), the Power Division, and the Finance Division have cleared the financing arrangements. “All codal requirements, documents, and guarantees are in place,” a senior official confirmed.

The financing package, worth Rs 1.225 trillion, differs slightly from the Rs 1.275 trillion approved by the federal cabinet earlier. Officials explained that the Rs 50 billion variation stems not from Chinese CPEC power producers’ willingness to waive late payment surcharges, but from the installment structure.

Payments have been capped at Rs 310 million per quarter, bringing the total down to Rs 1.225 trillion at KIBOR minus 9 percent over six years. A higher quarterly cap of Rs 325 million would have lifted the total to Rs 1.275 trillion, but that scenario would have increased the already politically sensitive debt servicing surcharge of Rs 3.23 per unit.

Out of the total financing, Rs 659 billion will go toward retiring loans owed by the Power Holding Limited (PHL). The use of the remaining funds—whether to pay independent power producers (IPPs), subsidize the petroleum sector, or adjust tariff subsidies—has not yet been finalized. For this reason, the Power Division has sought the Prime Minister’s guidance before signing the agreements. The ceremony is expected to take place at the Prime Minister’s Office.

Once the agreements are signed, the government will have 30 days to formally request disbursement. Withdrawn amounts must be used promptly to avoid penalties, and the government will then have three additional months to draw the requested sums. At that stage, authorities intend to test which IPPs—local or Chinese—are willing to accept discounted settlements on outstanding dues. This step was deliberately postponed until after the Prime Minister’s visit to China to avoid diplomatic sensitivities.

Eighteen banks are part of the agreement, including Meezan Bank, Habib Bank, National Bank of Pakistan, Allied Bank, United Bank, Faysal Bank, Bank Al Habib, MCB Bank, Bank Alfalah, Dubai Islamic Bank, Bank of Punjab, Bank Islami, Askari Bank, Habib Metropolitan Bank, Al Baraka Bank, Bank of Khyber, MCB Islamic, and Soneri Bank.

The federal cabinet had already given its nod to a wide-ranging set of measures. These included authorizing CPPA-G to act on behalf of Discos for circular debt restructuring, amending laws such as the Electric Power Act, Sales Tax Act, and Income Tax Ordinance through the upcoming Finance Bill, and approving substantial budgetary allocations. Immediate releases include Rs 267 billion already budgeted, and a technical supplementary grant of Rs 393 billion, both directed to CPPA-G.

In addition, CPPA-G has been empowered to use the proceeds to clear debts of government-owned power plants, settle Rs 683 billion in PHL obligations, and make payments to IPPs on the condition that they waive late payment interest. Amendments to the Pakistan Energy Sukuk Rules, 2019, were also approved, allowing early redemption of sukuk instruments.

This financing package is being hailed within government circles as a critical move to stabilize the power sector’s finances and restore confidence in energy payments, though its long-term success will depend on effective execution and cooperation from power producers.