ISLAMABAD: Pakistan is working on two financing plans to secure around $750 million (Rs213 billion) in the coming weeks through commercial borrowing and the country’s first-ever Panda bond issuance, according to a report in The News.

Islamabad intends to raise $300–500 million from a consortium of international banks, including Deutsche Bank and Standard Chartered, as it prepares to repay a $500 million Eurobond maturing on September 30, 2025. Meanwhile, the government is finalising the launch of a $250 million Panda bond in Chinese currency, likely by November.

Finance Minister Muhammad Aurangzeb confirmed that the inaugural Panda bond is a top priority. Structured with a three-year maturity and fixed-rate coupon, the bond will be privately placed in China’s Interbank Bond Market for institutional investors. With co-guarantees from the Asian Development Bank and the Asian Infrastructure Investment Bank covering up to 95% of the value, Pakistan expects to secure favourable terms despite its sub-investment credit rating.

Officials revealed that another Eurobond repayment worth $1 billion is due in April 2026. The State Bank of Pakistan and the finance ministry are exploring ways to meet liabilities without straining reserves.

Parallel to these financing efforts, the Federal Board of Revenue has launched a crackdown on influential tax evaders, particularly jewellers and real estate developers. Data collected shows over 60,000 jewellers operating in Pakistan, of which only 21,000 are registered with the FBR and barely 10,500 file tax returns. Notices are now being issued, starting with 900 jewellers from Punjab.

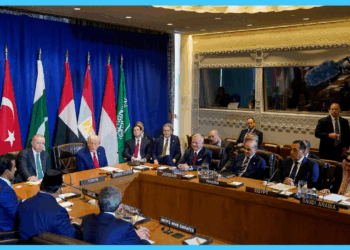

Meanwhile, Prime Minister Shehbaz Sharif has directed authorities to create a reform-based roadmap to boost investment in agriculture, IT, minerals, tourism, and renewable energy. He stressed the private sector’s role in economic revival and said timely completion of projects would help place Pakistan on a sustainable growth path.