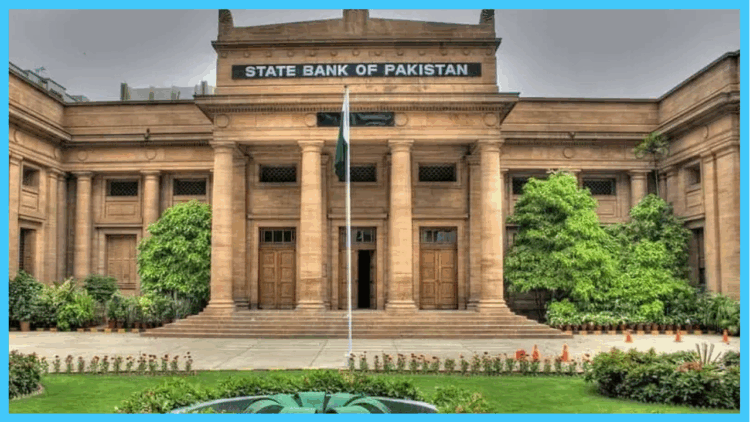

KARACHI; The State Bank of Pakistan (SBP) on Monday announced that the benchmark interest rate will remain unchanged at 11% for the next two months.

The decision was taken during the second meeting of the Monetary Policy Committee (MPC), chaired by SBP Governor Jameel Ahmad. The committee reviewed both domestic and international economic conditions before reaching its conclusion.

Agricultural Losses and Inflation Concerns

Economic experts highlighted that recent floods have caused severe damage to Pakistan’s agricultural sector, destroying major crops. As a result, the country may need to import key food commodities, which could increase the import bill and push inflation higher.

In light of these challenges, the SBP decided to maintain the current interest rate to support economic stability. This marks the third consecutive meeting in which the policy rate has been held at 11%. The central bank stressed that keeping the rate steady would help manage inflation while providing some relief to the economy.

A recent survey showed that 92% of respondents expected no change in the interest rate. In its previous meeting on July 30, the MPC also kept the rate unchanged, citing rising energy costs — particularly gas tariffs — as a major inflationary pressure.

Business Community’s Reaction

While the decision was largely in line with market expectations, it has faced criticism from the business community. Industrialists expressed concern that the high cost of borrowing is raising production expenses and hurting competitiveness.

Saquib Fayyaz, Senior Vice President of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI), warned that keeping the rate unchanged would further increase production costs and could potentially lead to a decline in exports.