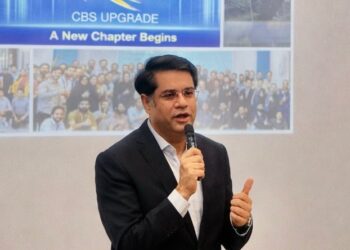

Web Desk; Millions of Pakistani citizens may face temporary disruptions to their digital banking and wallet services from October 25 if they have not yet completed biometric verification, as the State Bank of Pakistan’s (SBP) new regulations take effect.

The directive, introduced through BPRD Circular No.1 of 2025, was issued on July 25 and requires all financial institutions under SBP’s regulation — including Banks, Development Finance Institutions (DFIs), Microfinance Banks (MFBs), Digital Banks, and Electronic Money Institutions (EMIs) — to streamline their account opening and customer onboarding processes.

According to the new rules, biometric verification has been made the primary verification method for all bank accounts and digital wallets. Previously, account holders were given up to 60 days to complete this verification before a debit block was imposed.

With the new framework coming into force, industry insiders warn that tens of millions of users who have not completed their biometric verification may find their accounts blocked for transactions. Some financial experts also raised concerns that the regulation could impact individuals using foreign currency accounts, including those managing remittances through Roshan Digital Accounts.

The SBP had given financial institutions three months to ensure compliance, as part of its broader effort to strengthen Anti-Money Laundering (AML) and Countering Financing of Terrorism (CFT) mechanisms.

The updated ‘Consolidated Customer Onboarding Framework’ expands the scope of SBP’s oversight to include both in-branch and remote account openings. It applies to all individual and entity accounts — local and foreign currency — as well as Roshan Digital Accounts.

The 2025 framework replaces the 2022 version, where NADRA’s Verisys system was sufficient for initial verification, and biometric verification could be completed within two months. Now, biometric verification must be completed before establishing any new banking relationship or activating an account or wallet.

Industry observers view this as a step toward enhancing financial security and reducing fraud risks. However, they also caution that customers should act swiftly to avoid potential service suspension after October 25.