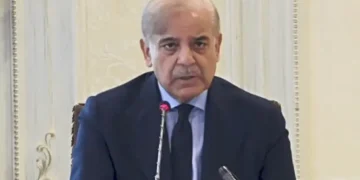

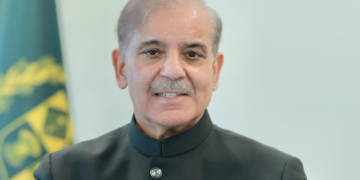

ISLAMABAD; Prime Minister Shehbaz Sharif has reaffirmed his government’s commitment to building a fair, transparent, and citizen-friendly tax system, emphasizing that the days of cumbersome tax procedures are over. Chairing a high-level meeting in Islamabad on Monday to review the progress of Federal Board of Revenue (FBR) reforms, he highlighted how critical these reforms are not only for improving national revenues but also for reducing the burden on ordinary citizens and restoring public trust in the taxation process.

In this context, the Prime Minister warmly welcomed the launch of simplified tax returns—now also available in Urdu for easier understanding—and directed officials to establish a dedicated helpline to assist citizens throughout the filing process. He stressed that tax reforms must be people-centric, designed to facilitate rather than intimidate taxpayers, particularly the salaried and middle classes who often shoulder the largest share of the burden.

Shehbaz Sharif further instructed that the new digital invoicing system should also be available in Urdu, ensuring maximum accessibility. To guarantee transparency, he called for a robust third-party validation mechanism across all FBR reforms. The Prime Minister noted with satisfaction that tax returns have now been digitized, simplified, and integrated into a central database, which will significantly streamline the filing experience. This, he said, would greatly benefit the salaried class and encourage broader participation. He also directed the launch of a nationwide public awareness campaign to inform citizens about these reforms and motivate them to file their returns under the new, user-friendly system.

Appreciating the tireless efforts of the Finance Minister, economic team, FBR Chairman, and staff, he credited them for the positive strides made so far. He reiterated that expanding the tax base while protecting low-income groups remains a top government priority. For the first time in Pakistan’s history, an AI-powered tax assessment system has been introduced, which the Prime Minister hailed as a breakthrough in reducing manual intervention and discretionary practices.

Highlighting the importance of integrating businesses into this new digital framework, he instructed that special facilities be offered to small and medium-sized enterprises (SMEs) to adopt the digital invoicing system.

During the meeting, officials briefed the Prime Minister on multiple fronts: progress on digital invoicing, the e-Bilty transport documentation system, simplified tax returns, the AI-based tax assessment platform, and the establishment of a central Command and Control Center. It was shared that this Center will be operational by September, enabling centralized data access and faster, evidence-based decision-making.

They also detailed the benefits of the AI-driven system, which now allows traders to submit advance declarations of goods even before ships arrive, with exemptions from upfront duties and taxes. This is expected to push advance declarations from a mere 3% to over 95%, facilitating direct container transport from ports to factories.

Discussing the digital invoicing initiative, officials informed that both large and small businesses will issue receipts through the FBR’s online platform at each point of sale or purchase. Within just a month, 8,000 invoices worth Rs 11.6 billion have already been processed. The system includes a taxpayer portal and a live monitoring dashboard, with integration to PRAL offered free of cost. Active training sessions for traders are underway. Once fully rolled out, businesses will no longer have to file separate sales tax returns, as all transactions will be recorded automatically in real time.